Tuesday, April 23, 2024, at 7:00 pm News Read 1,197 times VIANEN • Grid operator Stedin, developer HVBM Vastgoed...

And with the performance of Club Brugge, Nicky Hain is gradually ensuring that Bart Verhaegh can no longer ignore him...

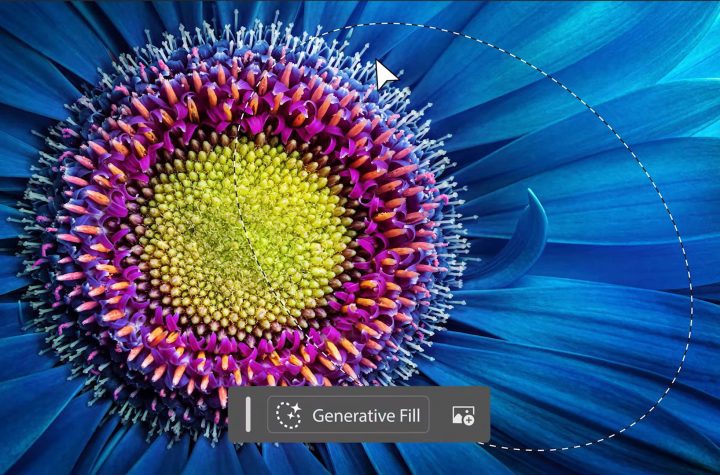

With the latest beta version of Photoshop, Adobe wants to get rid of the blank slate that everyone starts with....

45-year-old Kelly from Swansea (Wales) was bitten by a friend's dog. I cut off a piece of her face and...

Construction of the first high-speed line in the United States has officially begun at the future site of a station...

Rick Van Buymbroek is known for his narrative journalism. He has been declared a master storyteller several times by the...

NASA has once again received data about the status of computers aboard Voyager 1, one of two space probes beyond...

New iPad models with OLED display? Other surprises? The Apple Pencil is already an invitation staple. After the first event...

In a country of 1.4 billion people, about 80% consider themselves Hindu. About 14% of them are Muslim, but this...

The US House of Representatives has approved an amended version of legislation requiring TikTok parent company ByteDance to sell the...