Warning. The rise in credit card crime in the US is alarming. More than 10 percent of cardholders now pay only the minimum amount, which hasn't happened since 2019.

Why is this important?

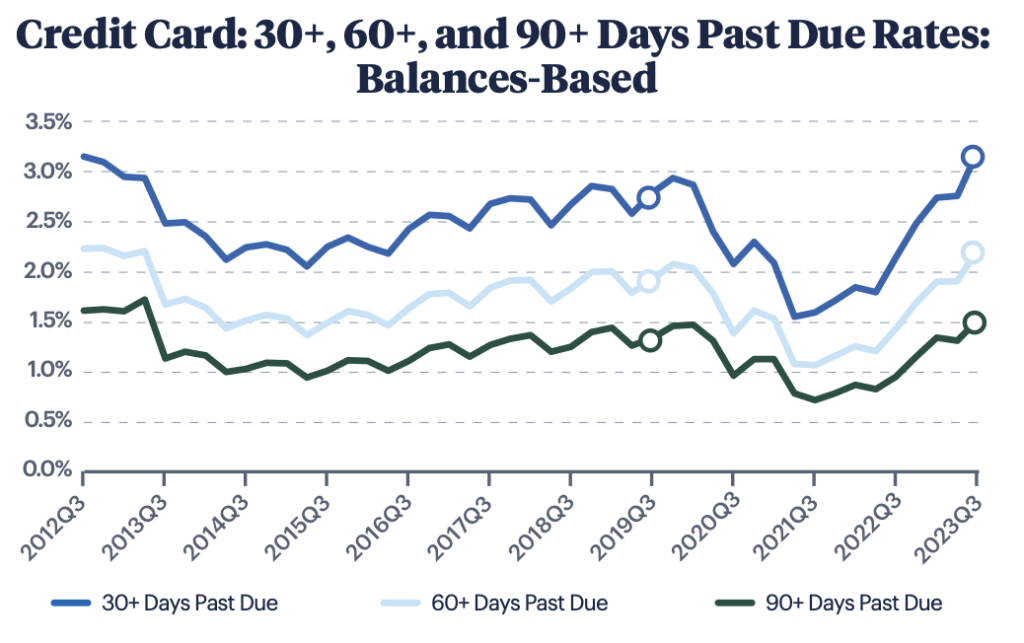

American consumerism saved the world from recession in 2023. But revealing this is the mounting financial pressure on American families. Rising cost of living, which is not always offset by higher incomes, pushes many people to accumulate more debt.In the message. According to A statement At the Federal Reserve Bank of Philadelphia, nearly 3.2 percent of credit card balances are at least 30 days past due. This is the highest rate in more than a decade and 40 basis points higher than the previous quarter. The number of loans overdue by 60 or 90 days has also increased.

Zoom in. Total revolving credit card balances rose to more than $600 billion in the third quarter of last year.

- About one in ten card users have their balance reaching 95 percent of its limit.

- Banks respond by raising credit limits less often and lowering them more often.

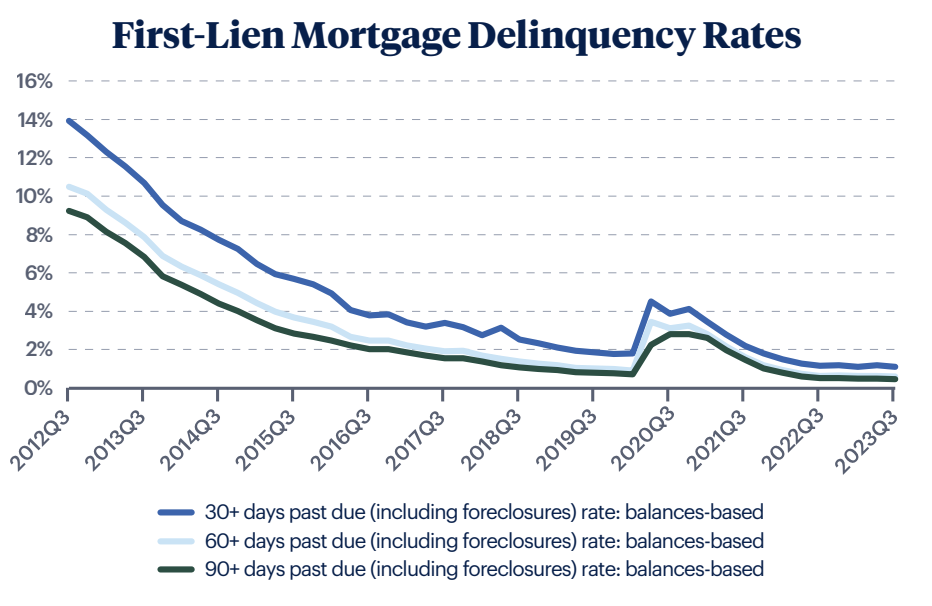

Zoom in. Unlike the situation with credit cards, Americans are paying off their mortgages better than ever. Mortgage loans have “improved to new all-time highs in recent quarters.”

- The figures reflect broader economic pressures following the pandemic, with rising costs not always matched by rising incomes.

“Introvert. Communicator. Tv fanatic. Typical coffee advocate. Proud music maven. Infuriatingly humble student.”

More Stories

Kennedy Jr. wants to put America's entire financial system on the blockchain

USA delivers another blow to Mexico in Eredivisie final

Solar Magazine – China Challenges US Tax Credit for Electric Cars and Solar Panels